Categories

In This Post

What is a Balance Transfer?

Why Do People Get Balance Transfers?

Does Spero Offer Balance Transfers?

Are There Any Drawbacks to Balance Transfers?

I’m Not Sure if a Balance Transfer Is Right for Me. Is There Someone I Could Talk To?

____________

Credit card debt can feel overwhelming, especially when you have multiple lines of credit you’re making payments on each month. Fortunately, there are many ways that you can tackle that credit card debt and get back on track.

One common method you can use is debt consolidation through a balance transfer.

What is a Balance Transfer?

A balance transfer is the process of shifting a balance from one credit card to another to help pay off credit card debt.

Let’s look at an example.

Imagine you have three credit cards from three different financial institutions. They all carry a balance: one is $1,000, another is $3,000, and the third is $5,000. That’s a total of $9,000 of credit card debt that you’re working on paying off, split between three lenders.

Don’t forget: not only are you responsible for the principal balance of $9,000, but you are also responsible for the interest that accrues on each balance every month.

In reality, you will end up paying much more than $9,000, especially considering you’re paying interest to three different institutions.

That’s a lot to keep up with, right? A balance transfer can help with that.

With a balance transfer, you would move those outstanding balances to one card. By doing so, you’ll simplify your repayment schedule – now you only have to keep track of one bill each month rather than three. Plus, you only have to worry about a single interest rate (which may be lower than what you’re currently dealing with).

Why Do People Get Balance Transfers?

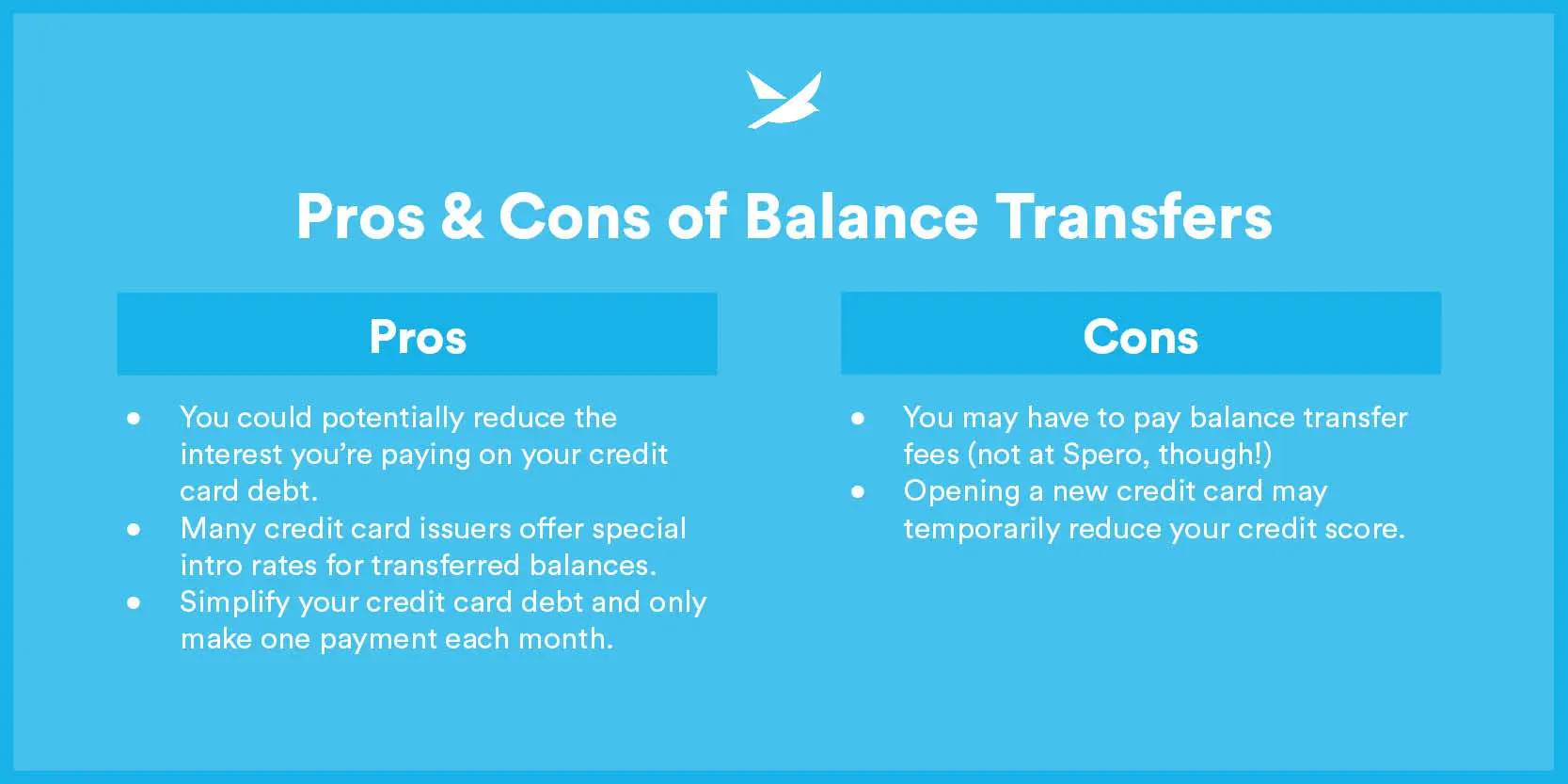

Like we’ve already established, balance transfers make repaying credit card debt easier by consolidating it onto one card, often with a lower interest rate. It’s a step to make repaying that debt easier to manage.

Does Spero Offer Balance Transfers?

Yes, you can transfer your high-interest credit card debt to a Spero Credit Card without having to pay any balance transfer fees! Click here to learn more.

Are There Any Drawbacks to Balance Transfers?

There are a few drawbacks to this approach.

Depending on what institution you choose, you may incur balance transfer fees (not at Spero, though!)

Balance transfers can also affect your credit score. When you open a new credit card, your chosen lender will complete a hard pull on your credit, which will ding your score. Opening a new line of credit will also reduce the average age of your credit accounts, which may also drop your score a little bit.

However, the impact on your credit score should be temporary as long as you stay on top of paying off the consolidated debt on the new card. In the long run, a balance transfer can actually improve your credit by helping you reduce the amount of debt you’re dealing with.

I’m Not Sure if a Balance Transfer Is Right for Me. Is There Someone I Could Talk To?

Yes! Click here to make an appointment with one of our Certified Financial Counselors and we can help you talk through your options.

Membership required. Insured by NCUA. Subject to credit approval. 6.90% introductory APR for 6 months from account opening on Purchases, Balance Transfers, and Cash Advances; after that, the variable APR will be 13.40% to 18.00%, based on your creditworthiness. Fees: Balance Transfer & Cash Advance Fee: $0.00, Returned Payment ("Charge Back") Fee: $8.00, Late Payment Fee: up to $25.00, Foreign Transaction Fee: 2% of transaction. Additional terms apply.

This material is for educational purposes only and is not intended to provide specific advice or recommendations for any individual.