Categories

Can you guess one of the most searched financial topics on Google? If you guessed “credit”, you would be correct! While credit isn’t at the top of the list for the easiest to understand, it is a financial topic that a majority of people have or will come in contact with over their lifetime. Why? Because credit is a foundational element in how we use money, especially when it comes to getting a loan.

With one credit related question generating 793 million results, it becomes tasking to figure out exactly which sources to trust - especially when there are differing views and opinions represented. That’s where we can help! Let’s breakdown some of the most asked credit questions!

1. What is a good credit score and what is it used for?

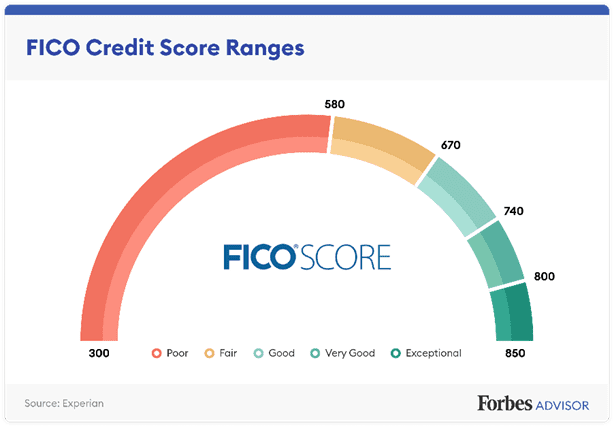

Credit scoring companies typically follow similar tiers to “categorize” credit scores. The most widely known credit scoring model is from FICO - ranging from “poor” to “exceptional”. Below is a chart detailing the numbered range for each category.

So, what is a credit score used for? Lenders use credit scores to justify approving or denying a credit application based on an assumed risk level. Credit scores represent the likelihood a borrower is to pay back money borrowed from a lender. The higher the credit score the more likely the borrower will pay back the loan; the lower the score the less likely the borrower will pay back the loan.

Credit scores also help determine what terms a borrower receives, and the interest rate he/she will qualify for. Meaning the higher the credit score, the better the interest rates and terms the borrower will receive. A good credit score means lower interest rates, which can amount to hundreds of thousands of dollars in a lifetime!

2. How do I find out what my credit score is?

While there are many ways to go about finding out your score, these are a few of the best ways:

- Credit bureaus.

The three major credit bureaus: Experian, Transunion, and Equifax allow you to pull your credit report for free once per year! While your free credit report will not include your score, it will allow you to review your report to determine if there are any inaccuracies, and you can always purchase your credit score directly from the bureau for a small fee. Inaccuracies can drastically impact your score, it’s important to regularly monitor your report.

2. Your credit/loan provider.

This is probably the easiest way to access your score since all major providers offer free access to credit scores on a regular basis. If your loan/credit provider offers an online payment portal, explore around to see if you can locate your score.

3. A credit or financial counselor.

Financial counselors are great resources when it comes to credit questions! Since they’ve been through specialized courses that prepare them for various financial topics, they are helpful in understanding different aspects of credit. Seek out financial institutions in your area and ask if they have Certified Financial Counselors. Spero Financial and other credit unions are a fantastic place to start!

4. Some credit scoring websites.

When looking to find your credit score online, make sure you are choosing free credit scoring websites! It is always a great idea to research these sites to make sure they are reputable. Remember that your score may report slightly lower or slightly higher than what it actually is.

3. How can I build credit?

The first step to building your credit score is to focus on your money habits! This differs from person to person so looking at your spending habits and figuring out how you can responsibility use credit is key. Sitting down with a financial counselor is also a great idea when analyzing your finances, as they can provide great resources, tools, and guidance to kickstart your credit building journey. Responsible credit use is vital. It is important to always make payments on time, to work on paying off any balances, and keeping your utilization ratio (how much credit you use versus how much is available to you) on the lower end.

While it can be overwhelming, understanding and building credit doesn’t have to be daunting! Start taking one step at a time by finding out what your score is, what is reporting on your credit, and what in your history might be affecting your score today. Then from there, you can begin to work on a plan to build your credit - whether that be reworking your budget to make sure you are making on-time payments each month, looking into debt consolidation, or anything in between!

Spero Financial has certified financial counselors that are ready to meet with you today! If you’d like a little guidance in your credit journey, reach out to us today to set up an appointment with a financial counselor.

This material is for educational purposes only and is not intended to provide specific advice or recommendations for any individual.