Categories

In This Post

Can Debt Ever Be Positive?

Your Credit Score is Your Financial Reputation

Be Strategic

Help is Available If You're Struggling with Debt

____________

Most Americans will deal with some level of debt in their life.

That sounds scary, but it doesn’t have to be. Although debt gets a bad rap, if you use it responsibly and strategically, it can become a powerful tool in your financial toolbox.

Can Debt Ever Be Positive?

You incur debt any time you owe an institution or individual money. Car notes, mortgage payments, and credit card bills – these are all forms of debt you may encounter in your daily life. Most people think of debt as an inherently negative thing, but it doesn’t have to be if used responsibly and strategically. Think of it as a neutral force that can go one way or the other depending on how you use it.

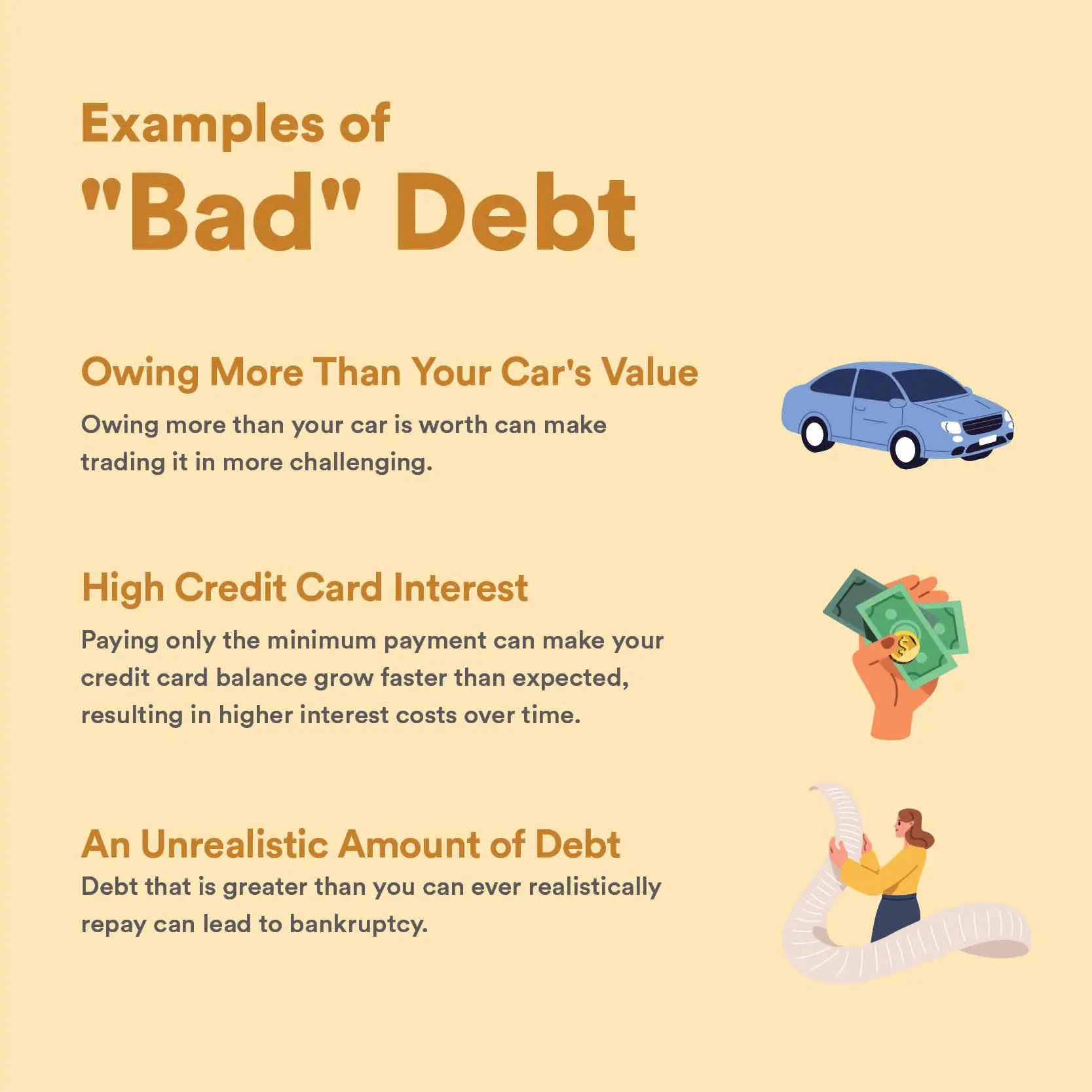

“Bad” debts just cost you money and cause stress. “Good” debts help put you in a better financial situation – they can help you gain assets and increase your credit score in the long-term.

Your Credit Score is Your Financial Reputation

Why does increasing your credit score matter? Think of it as your financial “resume” or “reputation” – it gives lenders a better idea of how likely you are to pay back what you borrow. The better your credit score is, the more lenders will trust you, which typically means access to more favorable rates and terms as long as you can show proof that you can reasonably afford it.

Debt is a key part of your credit score. Generally speaking, you will have to have some level of debt to have a credit score to begin with – that’s how you establish your payment history, for example. (Click here for details on how credit scores work.)

Managing debt responsibly today will help you take bigger financial steps in the future, like buying a home.

Be Strategic

So how can you make debt work for you?

- Be strategic about how much you borrow and where you borrow it from. Avoid payday lenders and other predatory institutions that offer unfair rates.

- Live within your means. This means only taking on debt if it is financially advantageous to do so, such as buying a home that will likely be a long-term financial gain.

- Avoid unnecessary spending. While shopping is fun, think twice before swiping your card. You should also weigh the pros and cons of opting into Buy Now, Pay Later options as they can create a debt spiral that is hard to escape.

- Set up auto-payments to avoid missing payments.

- Make sure you have a good mix of credit types. Lenders like to see that you can handle secured debts (like car or mortgages payments) as well as unsecured debts (like credit card payments).

It’s a good idea to keep an eye on your credit score to make sure your hard work is paying off – you can check it whenever you want in the Spero Financial Digital Banking app!

Help is Available If You're Struggling with Debt

While debt can be used to improve your financial situation, the current reality is that a lot of people are struggling. Many families don’t have the ability to create a strategy for how they use debt because they’re using it to survive.

Know that we are here to help available if you’re struggling with debt. Visit https://spero.financial/make-your-appointment/ to make a free appointment to speak with one of our Certified Credit Union Financial Counselors to see what options are available to you.

This material is for educational purposes only and is not intended to provide specific advice or recommendations for any individual.